The most popular investing search term in the United States according to Google isn’t natural gas, oil, or even bonds right now…

It’s gold.

And close behind it?

Silver.

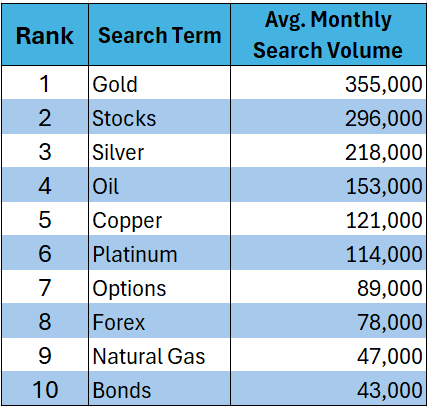

Here is a ranking of the search terms and the number of searches in the last month:

Now, most investors know gold tends to rise in uncertain economic times.

And with trade wards, recession fears, and geopolitical turmoil sweeping the globe, it’s easy to see why many Americans are looking into gold, especially since gold has been on a price tear for over a year. It broke its all-time high on April 22, and analysts forecast more record highs in the coming months.

But silver isn’t soaring…

Instead, it’s sitting at about 33% below its record high.

So, why are so many Americans looking into silver?

Several strong economic reasons exist, and they’re supplying a lot of price support for precious metals in general. But the biggest “technical” reason many investors are focusing on silver right now is…

The high gold-to-silver ratio.

Simply put, the gold-to-silver ratio is how much silver it would take to buy an ounce of gold..

Today, gold is around $3,200 an ounce, and silver is priced around $32 an ounce.

So, 3,200 divided by 32 is 100.

This means the current ratio is 100:1—it would take around 100 ounces of silver to buy 1 ounce of gold.

Why is this ratio so meaningful?

It’s all about the historic correlation between gold and silver. The chart below shows the gold-to-silver ratio:

In times of economic stress, silver’s price historically tends to rise when gold’s price rises as investors pour money into the precious metals sector.

And right now, silver should theoretically be keeping pace with gold.

Only, it isn’t.

Instead, many investors consider it massively undervalued… available at a discount.

And when the ratio between gold’s price and silver’s price is high like it is now, many investors expect silver’s price to rise over time as it starts to catch up with gold.

As silver’s price rises, the ratio between gold and silver tends to move back to its average ratio through a process called “reversion to the mean.”

For decades, the long-term ratio has averaged around 50:1.

With the ratio sitting around 100:1 right now…

Silver may have plenty of room to rise as the market adjusts.

And that market adjustment may be imminent.

Citigroup and Saxo Bank forecast silver prices reaching $40 this year.

And Investing Haven sees silver hitting $50 by the end of the year.

A main driver for higher silver prices?

Soaring industrial demand.

Demand for the precious metal is growing because silver is an essential component for tech products in several expanding industries.

The Silver Institute says the supply of silver can’t keep up: “The silver market is forecast to record another significant deficit for the fifth consecutive year in 2025 with volumes on track to surpass a record high of 700 million ounces this year.”

As industrial demand soars, silver’s price may have nowhere to go but up, and according to the Institute, “the [silver] sector should hit a new annual high this year.”

Their analysts also point to other drivers behind their market forecast:

- “Looking ahead, uncertainty over US trade and worries about US public debt levels should all reinforce interest in portfolio diversification, which in turn will benefit silver.”

- “Global photovoltaic installations [of solar panels that have silver in them] are expected to achieve another all-time high in 2025,” despite anticipated pressure on US renewable energy projects under President Trump’s administration.

- “The development of artificial intelligence systems will continue to boost product offerings,” which rely heavily on silver’s conductive properties.

Bottom line:

The gold-to-silver ratio is extremely high.

And the Silver Institute reports, “Investor sentiment has improved towards silver during early 2025,” a sign that momentum is building beneath the surface.

This flood of fresh buying on top of increased industrial demand, coupled with a “reversion to the mean” of the gold-to-sliver ratio, could push the precious metal’s price much higher in the coming weeks and months.

And if the popular investing sentiment reflected in Google searches is a reliable indicator, the trend may already be underway.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group