2025 started with a bang, but not the kind Washington wanted.

Biden’s Inflation Reduction Act—a centerpiece of the Administration’s economic strategy—was supposed to trim the deficit.

The plan was a bold policy attempt with a mix of tax tweaks and green energy initiatives.

And the White House’s 2023 “FACT SHEET” press release claimed the plan would cut the deficit by nearly $3 trillion over 10 years.

How’s it going, then?

So far, it’s barely shrunk.

In fact…

The deficit surged to $1.3 trillion, its second-highest six-month level on record.

And the national debt is rapidly closing in on $37 trillion.

This is spent money the government must pay back through various income sources, like a new round of money printing or “quantitative easing” … which could further weaken the flagging US dollar, push inflation higher, and stagnate economic growth.

Mostly, the money they need comes from federal tax receipts.

And right now, tax receipts are down.

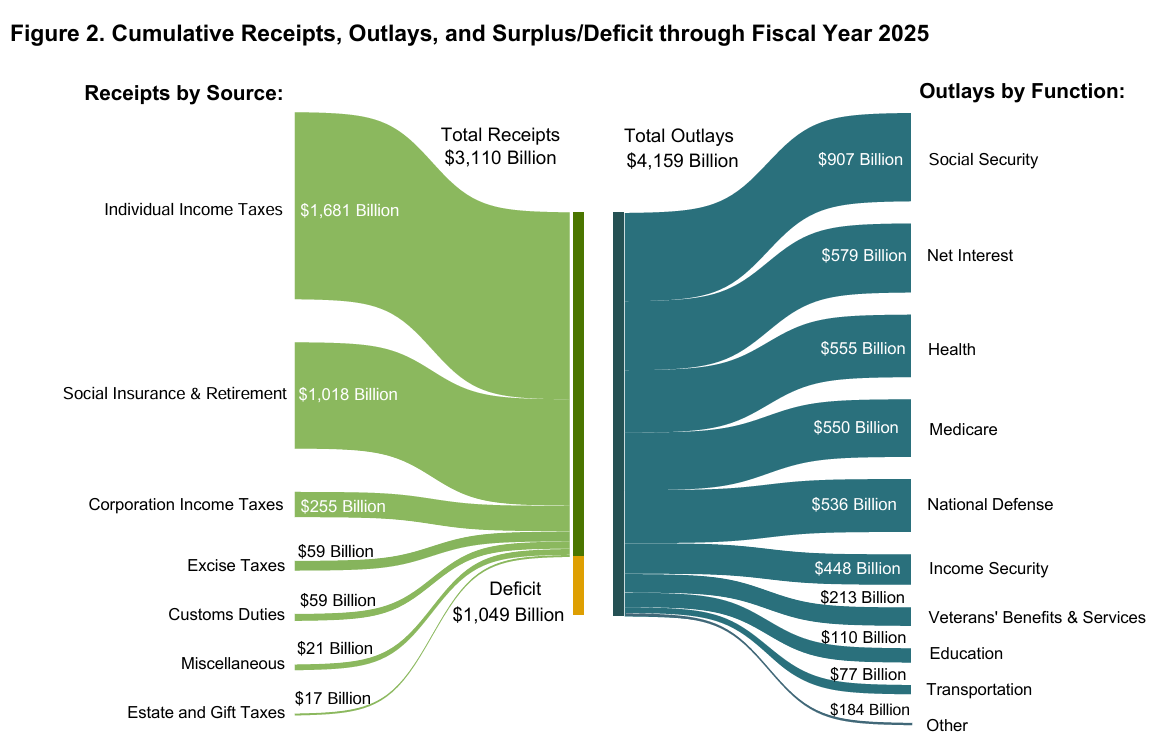

According to the US Treasury, total 2025 fiscal year receipts will be around $3.1 trillion… and total outlays will be $4.1 trillion:

And the Congressional Budget Office’s data show:

“From 2025 to 2035,” the deficit will “swell as increases in mandatory spending and interest costs outpace growth in revenues.”

And how do these deficits affect the national debt?

According to the CBO’s figures, the national debt will grow “from 100 percent of GDP this year to 118 percent in 2035, surpassing its previous high of 106 percent of GDP in 1946.”

What does this mean for the economy?

In the short term, borrowing, printing, and spending can stimulate the economy. But the long-term impact can be devastating.

As it stands, there is no clear path to reducing the debt and deficit.

America’s workers, entrepreneurs, industrialists, and taxpayers can’t produce enough capital to fund the government’s spending.

And if the Administration’s unsustainable spending continues unchecked…

PhD economist and fund manager Daniel Lacalle warns it will “lead to more massive money printing.”

What does this mean for savers?

Lacalle says it means “Your US dollars will be worth less, real wages will continue to show poor growth, and, after tax, disposable income will decline. The only way to protect yourself is to find alternative real reserves of value, [including gold], which will offset the monetary destruction that is about to accelerate.”

In other words, the Administration’s financial policies may weaken the economy…

But that will trigger a tremendous opportunity for gold owners in 2025 and beyond.

We know this is possible because history shows us…

As the national debt and deficit have grown over the years, so has the price of gold:

- In 1970, the US debt was $372 million, and gold was $35 an ounce.

- By 1980, the debt was $863 billion, and gold jumped to $653 per ounce.

- In 2010, the debt rose to $12.7 trillion… gold soared to $1,078.

- By 2020, the debt had nearly doubled to $23.2 trillion, and gold rose to $1,584.

- By 2023, the debt hit a staggering $31.4 trillion… gold: $1,982.

- In 2024, the debt soared to an eye-watering $36 trillion, and gold hit $2,606.

- And today, as the debt approaches $37 trillion, gold is hovering around $3,300… and many analysts expect it to soar to record highs in the coming months.

This is why owning gold isn’t just about reacting to current economic challenges…

It’s also about anticipating long-range trends, taking informed action, and feeling more confident and secure about your financial future despite the government’s debt problem and spending deficits.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group