As the nation faces growing economic uncertainty and analysts are warning of a recession, the quest for a stable financial future has never felt more urgent for many Americans.

But with so many economic challenges happening at once, charting a confident path to wealth protection can seem like a daunting task.

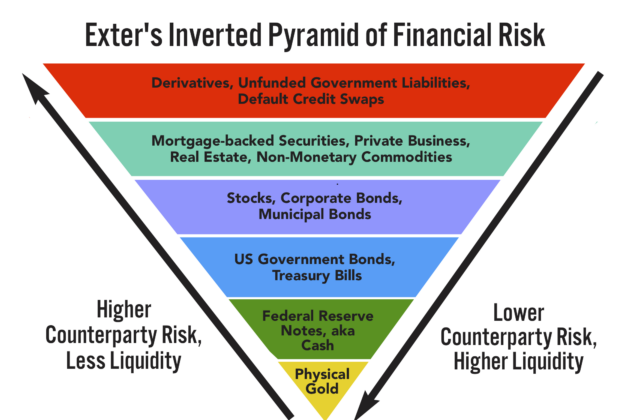

Fortunately, John Exter, an economist and former Fed official, created a useful model he called the “Inverted Pyramid of Risk” to help us understand the financial risks each of us is facing and how best to prepare.

And though his model was developed in the 1970s… it feels like he was predicting 2025.

The model is designed like an inverted pyramid, with its layers organized from the riskiest assets at the top to the safest at the very bottom. This is a very visual and easy way to understand the range of risks posed by assets:

Layer 1 and 2 – “Wall Street’s Playground”

This is where bankers, hedge funds, and big institutions play their dangerous games with complicated financial derivatives created for the purpose of chasing bigger returns by taking bigger risks. Think of these layers as casino assets.

And when markets turn south, this is the first part of the system to collapse, just like it did in 2008.

Layer 3 and 4 – Stocks & Bonds

Drop down a level and you’ll find the “safe enough” layer Wall Street tells the middle class to trust for long-term growth with their 401(k)s and retirement funds.

This layer might feel safer than the casino above it. But safer doesn’t mean safe.

Stocks are still vulnerable to interest rate hikes, inflation, and recession fears, while bonds can lose serious value when rates rise.

Layer 5 – Paper Money

Then there’s cash. And while cash feels like the safest thing in the world when markets are chaotic, cash still loses value to inflation every year.

As John Exter famously said, “The Fed doesn’t print wealth (‘cash’). It prints IOU Nothings.”

Layer 6 – Hard Assets like Gold

Finally, at the bottom of the pyramid, we find physical gold. Unlike all paper assets above it, gold can’t default, go bankrupt, be arbitrarily devalued, or drop to zero in value.

And understanding why capital flows into gold during times of economic crisis, like it has recently shown, is the key to knowing why owning gold now may be the wisest financial decision you can make.

Here’s how it works:

When the economy is going through good times, and everybody feels like they’ve got money to spend, most people (including Wall Street) start taking bigger risks.

But when people start worrying about layoffs, recessions, or their 401(k) taking a hit… That’s when everyone starts running for safety.

Which is exactly why when fear takes hold, history shows that money almost always ends up in one place: gold.

This is exactly what happened after the 2008 crisis.

Back then, Wall Street giants like AIG were sitting on a ticking time bomb—issuing 30 to 40 times more insurance on risky assets than they could ever hope to cover.

When the value of those assets dropped 30%, investors rushed to dump whatever they could before getting caught holding worthless paper.

And, according to the official government investigation into what happened: “Nearly $11 trillion in household wealth … vanished, with retirement accounts and life savings swept away.”

But while most assets were crumbling, gold owners rejoiced… as fleeing capital flowed into gold for protection and drove its price to record highs by 2011.

And here we are again.

Inflation is still hammering away at the dollar, and with tariffs all analysts say it is bound to rise higher. And millions of Americans are once again loading up on assets that feel safe like cash and bonds… until they aren’t.

Meanwhile, those who understand how money really moves during a crisis know better than to trust paper promises.

And they know history always showed that when fear grips the market, there’s always a mad rush for gold.

So, what’s next for gold?

Recently, gold prices have soared to unprecedented levels, surpassing a historic $3,500 per ounce, a clear signal of investors seeking refuge from volatile markets. That has led several analysts to adjust their gold price forecasts: JP Morgan has raised its forecast for 2025 to $4,000 an ounce, and some analysts are calling for higher numbers.

And right now, central banks around the world—the “smartest money on the planet”—are buying gold at the fastest pace in over half a century.

For everyday Americans, the message couldn’t be clearer.

The most powerful institutions in the world are moving their wealth away from the dollar and into gold now. And for anyone looking to protect their savings, their retirement, or their family’s legacy in the months and years ahead… that’s worth paying attention to.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group