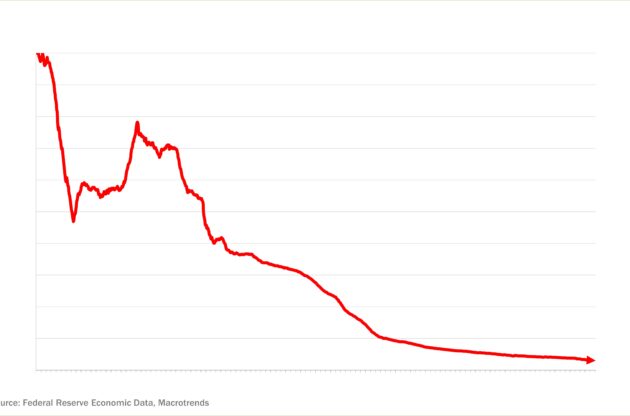

First, look at this line.

If you owned this flagging asset, would you hold on and hope for the best? Or would you look for a safer investment ASAP?

If the line represented your retirement savings, what would you do next?

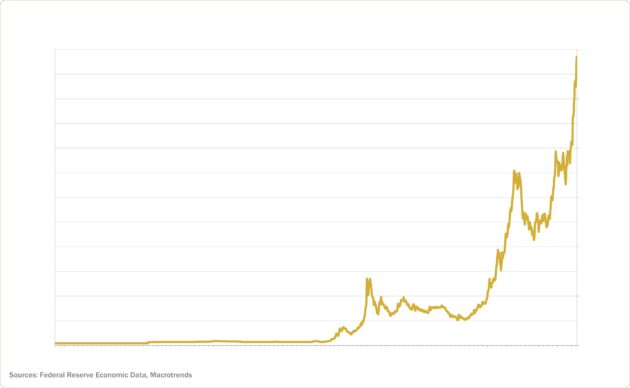

Now, consider this line:

If this line represented the value of your retirement savings, how would you feel about your financial future?

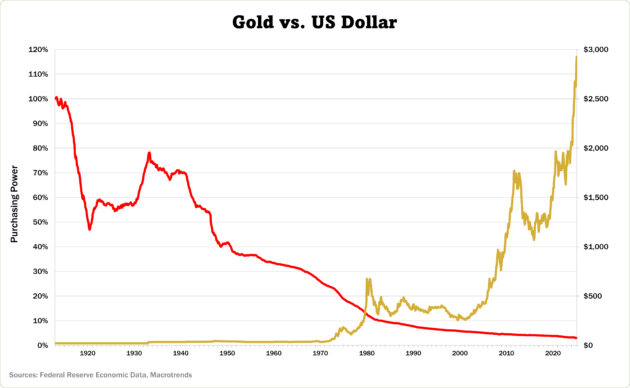

At some point, every serious investor must choose to either stay tied to a sinking asset or move their money to growth and safety.

And for anyone with all their savings held in US dollars right now, that crucial moment of choice may already have arrived.

Because the first chart above shows the dollar and reveals the dollar’s devastating loss of purchasing power over the last 100 years. And the second chart shows the stellar rise of the price of gold over the same period.

Unfortunately, many Americans don’t realize this is happening…

Because the mainstream financial media says the dollar is strong.

The Wall Street Journal says, “The Strong Dollar Is Rolling On Into 2025.”

And MarketWatch reports, “The U.S. dollar has never been stronger…”

The question is, why would the mainstream media say the dollar is strong if it’s clearly failing?

The answer is simple:

The Fed hiked interest rates several times to cool the flames of inflation. And these higher interest rates typically make “safe” financial products, like US government bonds, more attractive to foreign investors.

As a result, investors outside the US are selling their weakening currencies for “stronger” US equities denominated in dollars…

They’re pouring billions of those dollars into higher-yield assets…

And this global surge boosts the dollar’s value on the Fed’s “dollar index.”

This uptick looks fantastic on paper and makes for hopeful news headlines…

But behind the headlines, the US dollar is only “strong” relative to weaker global currencies. If you were living your life in a foreign country but holding dollars, you would be in great shape. But you are living in America, so the comparison between the dollar and the Japanese yen does not help you or your savings.

The truth is…

Since the Federal Reserve was established in 1913, the dollar has lost almost all of its purchasing power. It’s still falling, and it shows no signs of stopping.

So, why is this happening?

Money printing.

As the Fed floods the economy with printed dollars, inflation rises and the purchasing power of every dollar you’ve saved shrinks through simple dilution.

Meanwhile, the same money printing is causing gold’s price to soar to multiple record highs:

In 2024, gold hit 39 new peaks, and analysts say it has plenty of room to run as the dollar continues to fall. We’ve already seen several new records in 2025.

This is why thousands of aware Americans are rushing to acquire gold to protect their wealth while they still can.

Bottom line:

You don’t have to sit by and watch the purchasing power of your savings dwindle away.

You have a choice:

You can entrust your financial future to a shrinking asset with a dismal track record and little hope of recovery…

Or secure your savings with an asset with a stellar track record that has protected the wealth of prepared Americans during every major financial crisis in US history.

The decision is yours.

Please don’t hesitate to reach out to us for any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group