Do a Google search for “gold” and you’ll be overwhelmed by a mix of good advice, a few half-truths, and a heap of nonsense about the precious metal.

And for anyone who considers diversifying their 401(k) or IRA with gold, sorting facts from fiction can be challenging.

So today, let’s clear up 3 of the most common misconceptions about gold and shine a light on why so many are making the move to own it.

Starting with…

Misconception #1: Gold doesn’t belong in your 401(k) or IRA because it doesn’t generate income.

Many 401(k) and IRA owners have a robust portfolio of traditional, dollar-based “paper investments,” like stocks and bonds.

And the income-generating potential is attractive.

But what about protecting your life savings against losses?

We’ve all been taught the key is diversification.

The problem is…

After decades of money printing, soaring inflation, interest rate rollercoasters, deficit spending, and soaring national debt…

All those traditional, dollar-denominated assets are losing their purchasing power fast.

Unless those investments outpace inflation… What does it help you to own an asset that yields 7% a year if real inflation is at 9%?

Diversifying a portfolio of dollar-based investments with more dollar-based investments may not offer enough downside protection to counteract future purchasing power losses.

Enter gold.

Thousands of Americans turn to gold in times of economic uncertainty and inflation because they know:

- Gold has intrinsic value. It can never fall to zero.

- Unlike dollar-based paper and digital investments, gold has zero counterparty risk. It can’t default, go bankrupt, or be printed or created.

And, perhaps most importantly…

- The gold price tends to INCREASE while the dollar’s purchasing power dwindles as it has for over half a century.

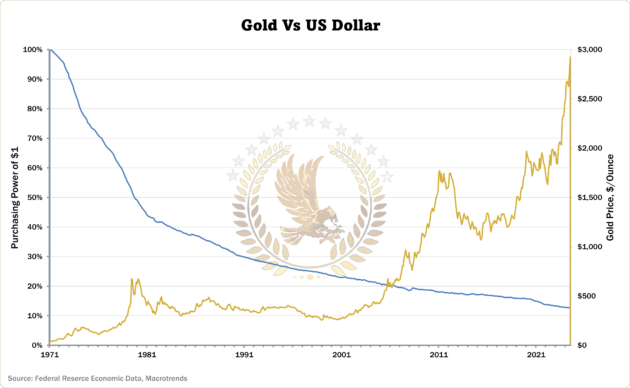

Since 1971, when Nixon nixed the Gold Standard, the US dollar has lost over 87% of its purchasing power.

Meanwhile, the price of gold has soared an astonishing 7,000%:

Gold set 39 new all-time highs last year and is off to a great start in 2025 with several new records. And analysts say the gold rally has plenty of room to run, forecasting $3,500 per ounce in 2025 and $4,000 in 2026.

Misconception #2: Owning gold ETFs is the same as owning physical gold.

In the last decade, many gold-backed exchange-traded funds (ETFs) have entered the market.

But you don’t own any of the gold with an ETF, and you can’t exchange it for physical gold. Instead, all ETF earnings are paid in dollars.

And for ETF proponents, that’s perfectly fine.

The challenge is…

Because buying Gold ETF shares is just like buying any company’s stock, they are subject to the same market volatility and counterparty risks as any other traditional paper investment.

But if you own physical gold, you eliminate those risks because you are the sole owner and holder of the gold.

This is one of the reasons why many of the world’s biggest central banks—the Smartest Money—are buying and hoarding massive amounts of gold in their vaults as a strategic hedge against economic uncertainty. Central banks avoid ETFs because they want to derisk their portfolio. Shouldn’t you do what the world’s Smartest Money does?

Misconception #3: Buying, storing and selling gold is complicated and risky.

Every week, we help retirement account owners who are concerned about this very issue. But when they decide to acquire gold, they’re often surprised to discover just how simple, fast, and safe the process really is.

It starts with a no-cost consultation with a gold specialist to clarify your needs, goals, and options. Then, when you’re confident with your choices and ready to proceed, the purchase is straightforward, and delivery is easy:

You can buy gold bullion and take direct, fully insured delivery to your home or a storage facility of your choice…

Or you can move a portion of your 401(k), IRA, TSP or other qualifying savings into a Gold IRA—tax-free and penalty-free—and your gold will be delivered directly to an IRS-approved, high-security, low-cost depository for safekeeping under your name and full control.

After that? Hold your gold until you’re ready to pass it to heirs or sell it.

Bottom line:

Despite the many misconceptions, physical gold’s stability as an asset is well-documented and known. What your grandparents considered the ultimate safe-haven is still just that.

With its long record of resilience and price appreciation, gold remains an important asset to consider for those who want to feel more secure in uncertain economic times and protect their financial future.

If you’ve been on the fence due to outdated myths, it might be time to give gold a closer look. After all, history shows that this “relic” has a history of shining brightly when everything else goes dim.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group