The last of the “big three” credit rating agencies, Moody’s, has downgraded the United States from AAA to AA1.

The firm cites that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.”

The downgrade is part of a pattern that’s becoming all too familiar.

And financial watchdogs are sounding the alarm over America’s fiscal direction, with each warning more urgent than the last.

The Peter G. Peterson Foundation says, “The [credit rating downgrade] warning should send a strong message to policymakers about the need to address America’s unsustainable fiscal path.”

Now, with the national debt growing at an alarming rate, the US government’s financial challenges follow suit.

“Over the next decade,” Moody’s added, “we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly rated sovereigns.”

CNN says, “It’s up to lawmakers on both sides to take actions to improve the nation’s fiscal situation, or another downgrade could be in the cards. And that one would likely be even more painful.”

But with Democrats sparring with Republicans over the spending levels of the current administration…

Plus, Republican hardliners advocating for deep spending cuts to tackle the debt and deficit…

The political climate in Washington is charged with tension and uncertainty.

Case in point: MSNBC says, “Republicans are again to blame for the latest downgrade of the US credit rating.”

And White House spokesperson Kush Desai says, “The Trump administration and Republicans are focused on fixing Biden’s mess by slashing the waste, fraud, and abuse in government … to get our house back in order.”

He adds:

“If Moody’s had any credibility, they would not have stayed silent as the fiscal disaster of the past four years unfolded.”

But this “buck passing” completely sidesteps the glaring issue of the US government’s excessive borrowing and spending… and how it is pushing the cost of borrowing through the roof.

If this continues, analysts believe the US might not be able to meet its debt obligations.

Because…

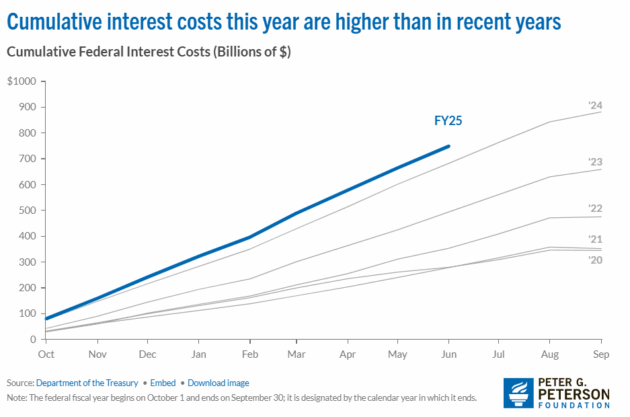

Interest on the debt is speeding towards $1 trillion per year.

Interest payments for the first seven months of fiscal year 2025 amount to $579 billion, which will bring us just an inch away from the $1 trillion mark at the end of the fiscal year.

The Congressional Budget Office projects that “if current laws generally remain the same, net interest payments will total $13.8 trillion over the next decade, rising from an annual cost of $1 trillion in 2026 to $1.8 trillion in 2035.”

And now it seems the deficit may be deepening to a point where it’s claiming a new casualty.

Sky-high interest rates are weighing down on all new Treasuries issued to cover current spending—and the old Treasuries that must be refinanced at higher rates—to help cover the deficits the government couldn’t cover already.

“US budget deficits are reaching the tipping point where they could start hurting stocks,” MarketWatch says.

Forbes agrees:

“The S&P 500 is now at a risk of a steep drawdown of 30%–50%.”

And while all this is unfolding, the US dollar’s value—and your purchasing power—is still shrinking fast.

The solution to runaway government spending, inflation, and market corrections is timeless: if you have gold, you are at ease right now. If not, give us a call and we’ll show you how easy it is to diversify and protect your life’s work.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group