The tariff rollercoaster has caused warning signals to flash across the US economy, and as financial markets experience volatility and consumer confidence wavers, it begs the question: “Are we in a recession?”

And retirement savers who want to protect their IRA or 401(k) with a proven safe-haven asset may then ask: “What could a US recession mean for gold?”

This article analyzes the current recession indicators, examines whether gold does well in recessions based on historical performance, and provides context for those considering gold as a potential hedge against US recession risks.

Are We in a Recession? Warning Signs to Watch

The simple answer is no because the National Bureau of Economic Research (the authority on whether the US is in a recession) hasn’t declared a recession yet. But economists are debating if we’re headed towards a recession in 2025 as the warning signs are certainly stacking up.

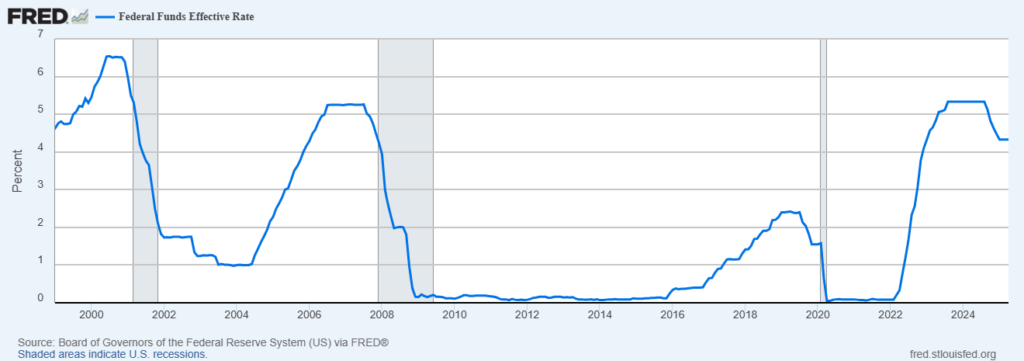

The Fed’s Rate Hiking Pattern and Historical Recessions

One of the most reliable recession predictors throughout history has been the Federal Reserve’s interest rate policy. Looking back, aggressive rate hiking cycles have consistently preceded economic recessions (the gray areas in the chart):

The Dot-Com Bubble (2001): The Fed pushed rates up from 4.75% to 6.5% in 1999–2000. Shortly after, the economy tanked as tech stocks crashed. The recession officially began in March 2001. During this period, we saw what happens to gold during a recession—it began its early stages of a multi-year bull market, showing that gold often performs well in recessions.

The Great Financial Crisis (2007–2009): Between 2004 and 2006, the Fed hiked rates from 1% to 5.25%. By December 2007, we were in what would become the worst recession since the Great Depression. Gold showed remarkable strength throughout this period, again demonstrating that gold typically goes up during a recession of significant magnitude.

The Pandemic Recession (2020): Though primarily triggered by COVID-19, it’s worth noting the Fed had already completed a rate hiking cycle from 0.25% to 2.5% between 2015 and 2019 before the pandemic hit. Gold reached new all-time highs during this economic shock, once again highlighting gold’s remarkable track record during a recession.

Current Situation (2025): Following the inflation battle, the Federal Reserve has kept interest rates at multi-decade highs. This extended period of tight monetary policy comes after one of the most aggressive rate hiking cycles in Fed history—from near-zero to over 5% in just a year and a half. This pattern looks alarmingly similar to what we’ve seen before previous recessions, which has many investors turning to gold as a potential portfolio stabilizer based on the historical pattern of gold’s great performance during recessions.

More Signs Pointing to a Possible Recession

Other economic indicators raising concerns about a 2025 recession scenario include:

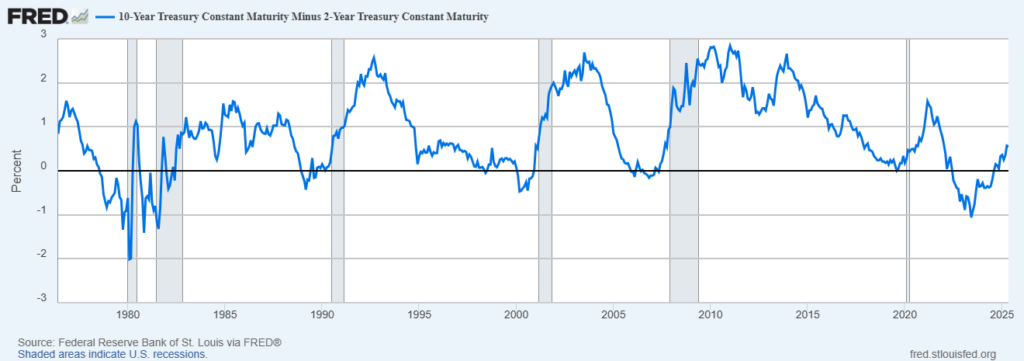

1. Inverted Yield Curve

The yield curve remains inverted, with short-term Treasury yields higher than long-term ones. This has predicted every US recession in the past 50 years, typically leading by 12–18 months.

2. Manufacturing & Services Contraction

Both the ISM Manufacturing and Services indices have dipped below the 50 threshold (contraction zone) in recent months, signaling weakened business activity.

3. Declining Retail Sales

Retail spending has slowed as consumers cut back due to inflation and economic uncertainty. Q1 2025 saw the first quarterly drop in consumer spending since the pandemic. Spending has picked up after the tariff announcements as consumers want to make their purchases before tariffs take effect or increase, at which point spending will likely drop again.

4. Rising Unemployment Claims

Initial jobless claims have been increasing since January, a sign that the labor market may be weakening. Over 172,000 job cuts were announced in February 2025, followed by 275,000 in March.

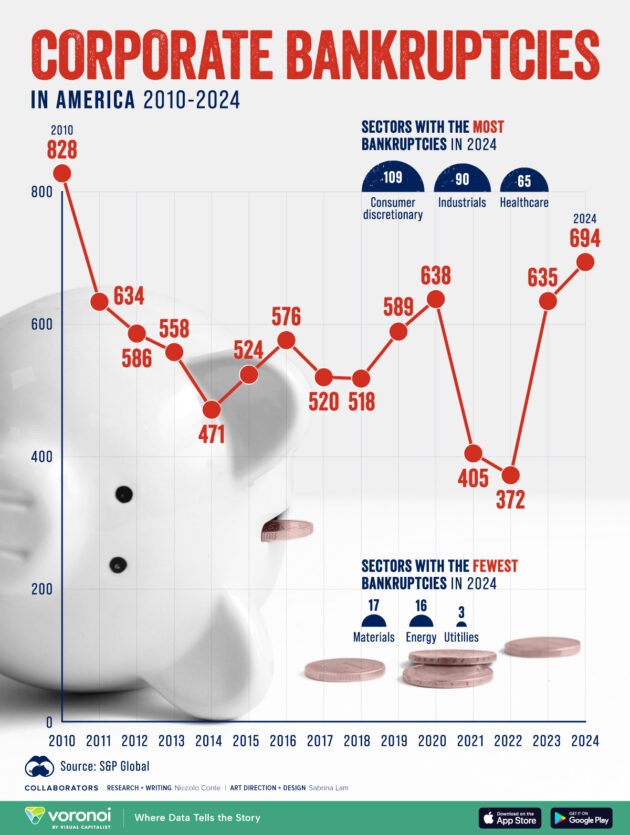

5. Corporate Bankruptcies

Business bankruptcies reached a 14-year high at the end of 2024, with nearly 700 companies filing. And the trend seems to continue in 2025 with 188 filings in the first quarter. Rising defaults often accompany or precede broader economic downturns.

6. Leading Economic Indicators Declining

The Conference Board’s Leading Economic Index (LEI) has been falling steadily, which historically signals a downturn 6–9 months ahead. And we’re seeing the US economy struggling—the GDP for Q1 2025 shrank for the first time in years.

While nobody has a crystal ball to predict exactly when a recession might hit, these signals suggest it’s time to take the possibility seriously—especially if you’re nearing or in retirement. Many forward-thinking investors, such as central banks, are increasingly looking at gold’s historical performance during similar economic conditions as a guide for potential portfolio adjustments.

What Happens to Gold Prices During a Recession? Historical Performance Data

To understand what happens to gold during economic downturns and whether gold prices go up in a recession, let’s examine gold’s performance during the last three major US recessions:

The Dot-Com Recession (March 2001 – November 2001)

During the recession triggered by the tech bubble burst and made worse by the September 11 attacks, we can see what typically happens to gold prices during a recession: gold went up by 19%.

Several factors drove gold’s positive performance:

- The Federal Reserve rapidly cut interest rates from 6.5% to 1.75%

- The dollar weakened significantly as monetary policy loosened

- Global uncertainty increased following the September 11 attacks

- Physical gold demand increased as investors sought tangible assets

Gold began what would become a multi-year bull market during this recession, eventually rising from around $260 per ounce in 2001 to over $1,800 by 2011. This decade-long move was initially catalyzed by the economic conditions created during the dot-com recession.

The Great Financial Crisis (December 2007 – June 2009)

The worst recession since the Great Depression provides perhaps the clearest example of how gold performs during a severe economic downturn: the price of gold increased by 69%.

Gold went up during this recession, delivering strong returns when most other assets struggled. Gold’s exceptional performance during this period may have been influenced by:

- Unprecedented monetary stimulus and quantitative easing

- Banking system instability raising questions about financial assets

- Currency debasement concerns as the Fed expanded its balance sheet

- Safe-haven demand as other asset classes experienced extreme volatility

- Institutional investors significantly increasing gold allocations

Even after the recession officially ended, gold continued its upward trajectory for another two years, ultimately reaching its then-record high of $1,895 in September 2011. This prolonged bull market demonstrated gold’s potential not just during the recession itself but in the economic aftermath as well.

The COVID-19 Pandemic Recession (February 2020 – April 2020)

This brief but severe recession offers a modern case study on whether gold does well in a recession, and gold once again demonstrated historical strength as its price went up 24%.

Gold’s strong performance reflected:

- Massive monetary and fiscal stimulus measures

- Near-zero interest rates reducing opportunity costs for holding gold

- Inflation concerns as government spending surged

- Supply chain disruptions in physical gold markets creating premiums

- Heightened global economic uncertainty

After initially selling off alongside other assets in the liquidity crunch of March 2020, gold quickly rebounded and reached an (at the time) all-time high of $2,067 per ounce in August 2020, demonstrating its resilience and eventual strength during this economic contraction.

The Bottom Line: Does Gold Go Up in a Recession?

This historical track record is clear and answers the question “does gold go up in a recession?” The data shows that yes, gold has consistently performed well during economic downturns. Several important patterns emerge:

- Positive Performance: Gold has performed well during each of the last three recessions, averaging +37% during these periods.

- Counter-Cyclical Movement: While the S&P 500 declined by an average of 29% during these same recessions, gold moved in the opposite direction, creating an average performance advantage of 66 percentage points.

- Extended Strength: In two of the three cases, gold continued appreciating significantly after the official recession ended, reaching new record highs in the post-recession environment.

- Physical Asset Advantage: As a tangible asset without counterparty risk, gold demonstrated stability during periods when the financial system experienced severe stress.

This track record helps explain why many investors consider allocating a portion of their portfolios to gold, particularly when recession indicators are flashing warning signs.

Why Does Gold Do Well in a Recession? Understanding the Economic Factors

The consistent pattern of gold performing well during recessions isn’t coincidental. Understanding the economic mechanisms that drive gold prices higher during downturns helps explain why gold typically goes up when the broader economy struggles.

The Recession Cycle and How Gold Prices Respond

Market Correction Stage: Recent data shows the stock market experienced a dramatic 10% plunge over just two trading days in early 2025. Historical patterns indicate that nearly half of all market corrections of this magnitude lead to a recession within a year.

During initial market corrections, what happens to gold prices can be mixed at first, as investors sometimes raise cash by selling all assets. However, gold typically stabilizes more quickly than equities and begins to outperform as the correction deepens, showing that gold often does well even in the early stages of economic stress. And we’re seeing that happen today as gold has reached one record after another in 2025, breaking the $3,500 mark in April.

Consumer Pullback Stage: Consumer spending during Q1 2025 shrank for the first time since the pandemic. As consumer activity accounts for approximately 70% of US economic output, this represents a concerning development.

As consumer spending contracts, central banks typically respond with monetary easing. These policy shifts—lower interest rates and potential quantitative easing—create an environment where gold has historically thrived as the opportunity cost of holding non-yielding assets decreases.

Business Impact Stage: Corporate bankruptcies have recently soared to 14-year highs according to S&P Global, with filings reaching 694 companies by the end of 2024. Job losses are mounting, with U.S. employers announcing 172,017 cuts in February 2025, rising to 275,000 in March—the largest monthly layoff figure since the 2008 financial crisis.

During periods of business distress, counterparty risk and financial system concerns typically increase. Gold’s status as an asset without counterparty risk often becomes more attractive during these phases as investors question the stability of various financial instruments.

External Pressure Stage: The BRICS nations have been increasingly coordinating economic policies that challenge dollar dominance. Their recent announcements about settlement mechanisms that bypass the US dollar represent potential pressure on America’s reserve currency status.

Currency concerns typically benefit gold, which has served as an alternative monetary asset for thousands of years. As questions emerge about fiat currencies, gold often gains increased attention as a recognized store of value outside the banking system.

Why Recessions Often Create Favorable Conditions for Gold

The policy responses to recessions typically create an environment conducive to gold price appreciation:

- Interest Rate Reductions: Central banks slash rates to stimulate economic activity, reducing the opportunity cost of holding gold.

- Quantitative Easing: Money supply expansion raises concerns about currency debasement and long-term inflation, historically supportive factors for gold.

- Fiscal Stimulus: Government spending increases to counteract economic weakness, often leading to higher debt levels and potential currency pressures.

- Flight to Safety: Investor risk aversion increases during recessions, benefiting traditional safe-haven assets like gold.

- Financial System Concerns: Questions about counterparty risk and banking system stability can enhance gold’s appeal as an asset outside the financial system.

These factors help explain why gold has demonstrated a tendency to outperform during recessionary periods and why many investors increase their allocations to precious metals when recession indicators flash warning signs.

Conclusion: Will Gold Go Up if a Recession Hits in 2025?

The evidence suggests that recession risks for 2025 deserve serious consideration. From the Federal Reserve’s extended high-rate policy to the inverted yield curve and from market corrections to consumer spending contractions, multiple warning signs indicate potential economic challenges ahead.

For those wondering “does gold go up in a recession?” or “what happens to gold prices during economic downturns?”, the historical record is quite clear. In each of the last three recessions, gold has not only maintained its value but appreciated significantly.

And gold also shows post-recession strength: Gold has shown a tendency to continue appreciating after recessions officially end, suggesting that gold’s upward price movements may extend beyond the immediate economic contraction period.

While past performance doesn’t guarantee future results, gold’s historical track record of performing well during economic downturns provides context for its potential behavior if recession concerns materialize.