Say what you will…

But gold’s historic performance is impossible to ignore.

Since January, gold has zoomed past NINETEEN all-time highs… so far.

And Barron’s doubles down on the trend.

As you can imagine, folks who acquired gold even just months ago are thrilled.

And those who do it now may look back in the coming weeks and months and be so glad they acted fast because…

If the flood of forecasts from some of America’s most credible analysts are correct, we may be on the verge of a massive, historic bull run I’m calling:

“The 2025 Great Gold Rush!”

“The surge in gold prices to unprecedented levels has captured the attention of investors worldwide,” says Nigel Green, chief executive officer at deVere Group.

And as new gold buyers around the globe pile in, gold suppliers face unprecedented demand, and the pressure pushes gold to astonishing highs.

The question is…

How high will gold soar?

Bank of America sees gold hitting $3,500 per ounce, with investment demand and central bank buying driving the surge.

And Luciano Duque, chief investment officer at precious metals mining consulting firm C3 Bullion, says, “Given the increasing demand for physical gold, finishing 2025 at the $3,500 mark might even look conservative.”

Analysts are raising their forecasts left and right because this is all happening so fast.

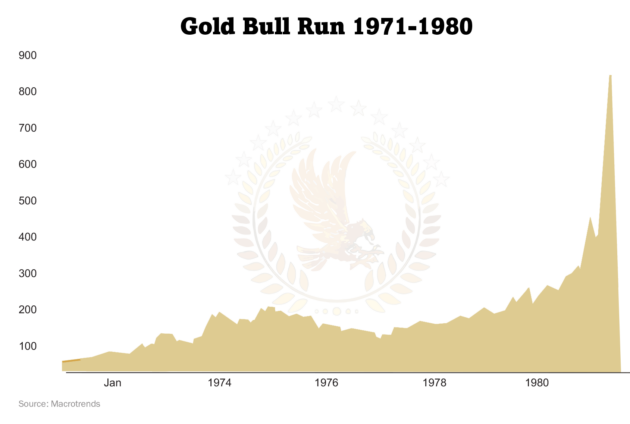

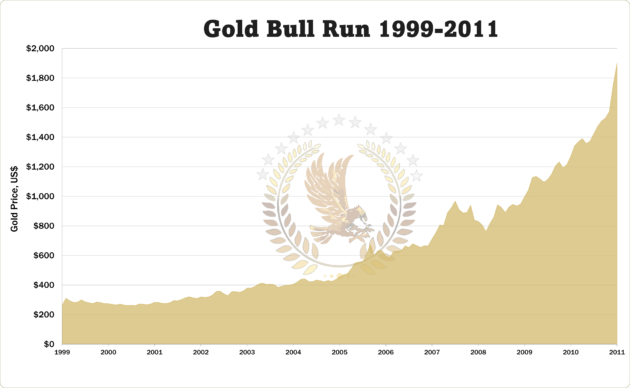

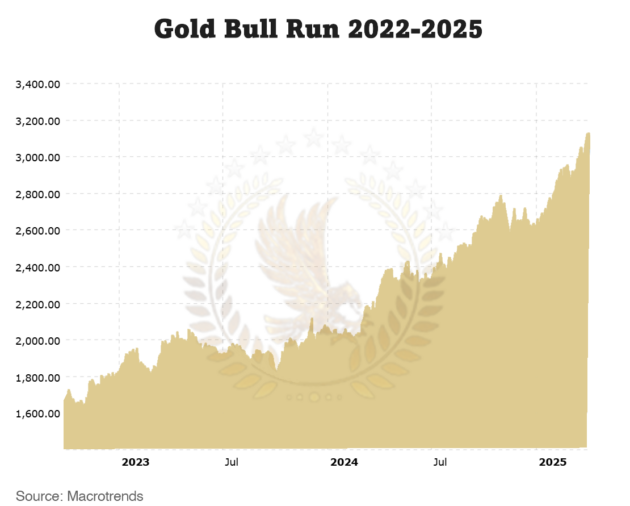

And it may be starting to look a lot like earlier gold bull markets in US history:

Like the bull market in gold from August 1971 to January 1980 after Nixon decoupled the dollar from gold: inflation soared, and the price of gold rose from $35 to over $800 for a 2,200% gain…

Or the gold bull market from August 1999 to August 2011—through the 2000 dot com bust and the crash of 2008… when gold rose from $250 an ounce to $1,900 an ounce for a 670% gain…

Or the current run-up, when gold rose from $1,630 in November 2022 to $3,231 per ounce today, April 11, for a 98% gain.

Now, several potential catalysts for another gold bull market are converging at once…

- Economic and geopolitical tensions are rising…

- The government is spending taxpayer money like there’s no tomorrow…

- And the US dollar is losing purchasing power fast…

That’s the economic fundamental side.

And here’s another reason gold may push even higher:

Global central banks—the World’s Smartest Money…

With access to buildings full of PhD economists, computers, and the most accurate data on the planet… bankers with the ability to buy as many US dollars as they like with the currency that they print themselves… are buying gold at a rate never seen in 50 years.

Why are the world’s biggest investors buying so much gold so fast?

In part because they may be losing confidence in the US dollar.

They know the Fed’s policies and the US government’s spending habits are eroding the dollar’s purchasing power fast. And they know gold rises as the dollar’s purchasing power drops.

Bottom line:

If you don’t own gold or are considering adding more to your holdings, you haven’t missed the boat yet. Compared to where the price of gold will go in case of a full-blown crisis, the boat is still in the harbor.

But with every economic indicator blinking red and foreign powers acting the way they are, we may be heading into the biggest, longest gold bull run in US history.

Please don’t hesitate to reach out to us with any questions you may have.

May you be safe and well during these uncertain times.

Todd Sawyer, Director of Client Education

Colonial Metals Group